With 78 deals totaling $11.3 billion, merger and acquisition activity in New England bounced back strongly in the first quarter of this year.

With 78 deals totaling $11.3 billion, merger and acquisition activity in New England bounced back strongly in the first quarter of this year.

According to Mergermarket, the region hasn’t seen a quarter with that level of activity since the second quarter of 2011, when deal value totaled $13.5 billion. Massachusetts, in particular, led New England’s M&A rebound with 45 deals totaling $4.3 billion, a 32.4 percent increase in deal count compared to the previous quarter, according to Mergermarket’s data.

“I think one of the things we’re seeing — not just in New England, but a trend nationwide — is strategic buyers who have been sitting on the sidelines … are starting to come out of their recessionary shell and look at a lot of nice assets out there,” says Jane D. Goldstein, co-head of the M&A department at Ropes & Gray. “I think we’re seeing a trend of these companies being a bit more bullish.”

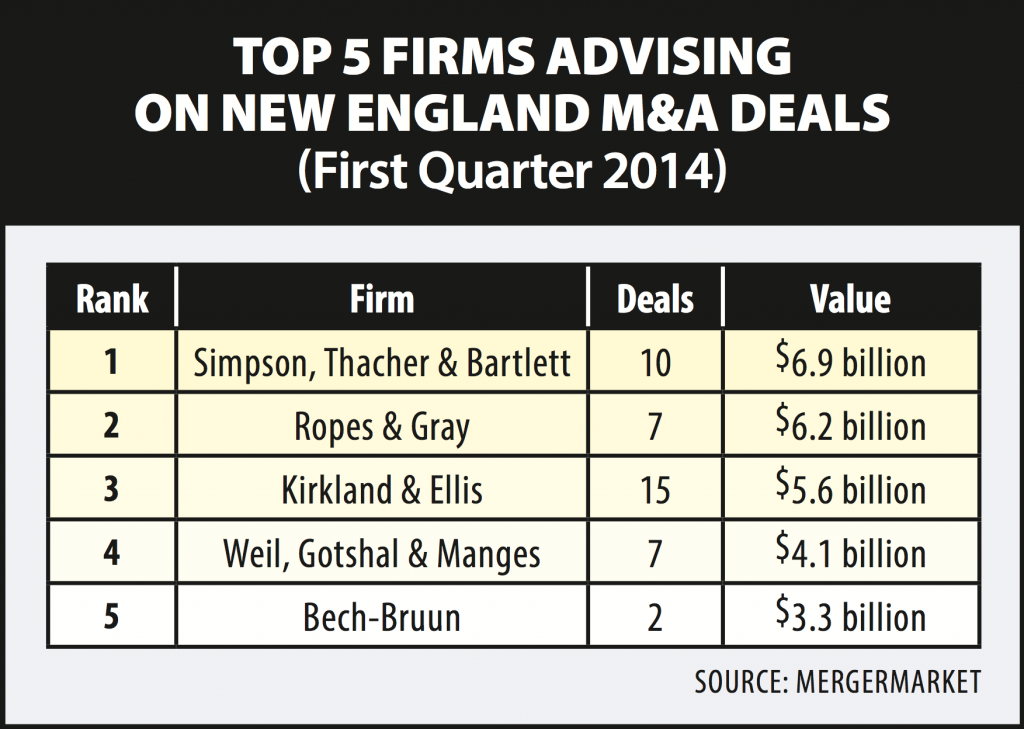

Ropes & Gray served as legal adviser on seven deals in the first quarter totaling $6.2 billion. Goldstein says New England benefitted from the fact that some of the most active industries for M&A right now — technology, financial services, biotechnology and pharmaceuticals — have long been prominent in the region, particularly Boston.

With deals such as Charterhouse Capital Partners’ buyout of SkillSoft for $2 billion, technology overtook industrials as the main driver of M&A in New England in the first quarter, Mergermarket reports. That could be good news for Goodwin Procter, which PrivCo recently ranked as the second most active law firm in private company technology transactions in 2013.

Goldstein expects industrials to continue to slide.

“My understanding from talking to people in the market is that industrials are pretty quiet right now,” she says.

Goldstein says the consumer sector, however, “is hot.” An example of a consumer sector deal from the first quarter would be Coca-Cola’s acquisition of a 10 percent stake in Vermont-based Green Mountain Coffee Roasters for $1.3 billion

New England Biz Law Update

New England Biz Law Update