An applicant whose claim for long-term disability benefits was denied by a plan administrator is entitled to recover the fees she incurred in obtaining a remand order on appeal, the 1st U.S. Circuit Court of Appeals has ruled in a split decision.

An applicant whose claim for long-term disability benefits was denied by a plan administrator is entitled to recover the fees she incurred in obtaining a remand order on appeal, the 1st U.S. Circuit Court of Appeals has ruled in a split decision.

The plaintiff applicant requested an award of fees under the Employees Retirement Income Security Act, 29 U.S.C. §1132(g)(1), because she achieved “some degree of success on the merits.”

The 1st Circuit granted that request.

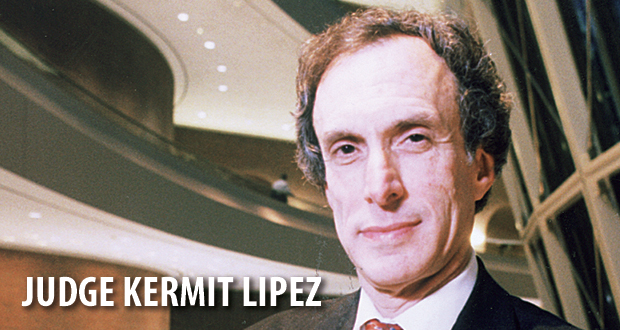

“Here, … [the plaintiff] secured a ruling on the standard of review that improved her likelihood of success on the merits of her claim and will impact all similar future claims,” Judge Kermit V. Lipez wrote for the majority. “[The plaintiff] obtained more than merely a second chance for ‘a full and fair review’ of her claim by the plan administrator.”

Judge Bruce M. Selya dissented, writing that “all we have here is a remand alone — and a remand alone is not enough to pave the way for a fee award under 29 U.S.C. §1132(g)(1). Put another way, a fee award at this juncture would be at best premature and at worst gratuitous.”

The 36-page decision is Gross v. Sun Life Assurance Company of America.

Kentucky attorney Michael D. Grabhorn represented the plaintiff. He was opposed by Joshua Bachrach of Pennsylvania.

Remand ordered

Plaintiff Diahann Gross was placed on disability leave at the age of 34 based on her complaints of severe pain, weakness and numbness in her arms and legs, and recurring headaches. Her treating physician attributed the symptoms to various medical conditions, including fibromyalgia and reflex sympathetic dystrophy, and concluded that she was unable to work.

In denying long-term disability benefits to the plaintiff, defendant Sun Life Assurance Co. of Canada relied heavily on video surveillance that showed the plaintiff engaged in activities that appeared inconsistent with her self-described physical limitations.

On appeal, the plaintiff asserted that policy language “requiring proof of disability ‘satisfactory to us’ is inadequate to confer the discretionary authority that would trigger deferential review.”

The 1st Circuit agreed, departing from its 2003 holding in Brigham v. Sun Life of Canada. The court also concluded that the administrative record was “inadequate to allow a full and fair assessment of Gross’s entitlement to disability benefits” and therefore remanded the case to allow further development of the evidence.

After obtaining the remand order, the plaintiff requested an award of counsel fees.

Degree of success

Under ERISA, a court “in its discretion may allow a reasonable attorney’s fee and costs of action to either party” in a benefits proceeding.

In Hardt v. Reliance Standard Life Ins. Co., the U.S. Supreme Court in 2010 clarified that eligibility for an award under section 1132(g)(1) does not require that the fee-seeker be a prevailing party, but only that the “claimant show[] ‘some degree of success on the merits.’”

The Supreme Court declined in Hardt to decide “whether a remand order, without more, constitutes ‘some success on the merits’ sufficient to make a party eligible for attorney’s fees under §1132(g)(1).”

Lipez said most courts considering the question left unanswered in Hardt have held that a remand to the plan administrator for review of a claimant’s entitlement to benefits, even without guidance favoring an award of benefits or an actual grant of benefits, is sufficient success on the merits to establish eligibility for fees under section 1132(g)(1).

“[W]e find the majority position persuasive,” he stated.

In Gross, he said “we need not finally resolve the adequacy of a ‘remand, without more,’ or the characteristics of a qualifying remand. Like the plaintiff in Hardt, Gross obtained more than merely a second chance for ‘a full and fair review’ of her claim by the plan administrator.”

In ordering a remand, “we made a substantive ruling on the standard of review that altered the dynamic between Sun Life and Gross in the subsequent proceedings,” Lipez said. “Contrary to Sun Life’s and our dissenting colleague’s insistence, that legal decision had more than procedural impact. It increased the likelihood of a favorable benefits determination — perhaps from Sun Life, and certainly from a reviewing court in the event Gross’s claim is again denied by the claims administrator — because Sun Life’s judgment will no longer be insulated from full judicial review.”

The defendant argued that the fee request was premature because the plaintiff’s benefits claim was not yet fully decided. The 1st Circuit majority disagreed, finding the plaintiff’s motion for fees to be ripe for adjudication.

“Without some prospect of compensating their attorneys along the way, ERISA litigants may face difficulty both securing counsel initially and retaining counsel as proceedings move forward,” Lipez said. “We see no justification for a delay that might add to that risk.”

Although “the balkanization of the fees issue may not be ideal in terms of court efficiency, the facts pertinent to fees motions covering separate phases of the case will not substantially overlap,” he added. “Hence, without minimizing the burden on the district court, we decline to prioritize marginal efficiency over the possibility of better access to skilled counsel for ERISA claimants.”

New England Biz Law Update

New England Biz Law Update